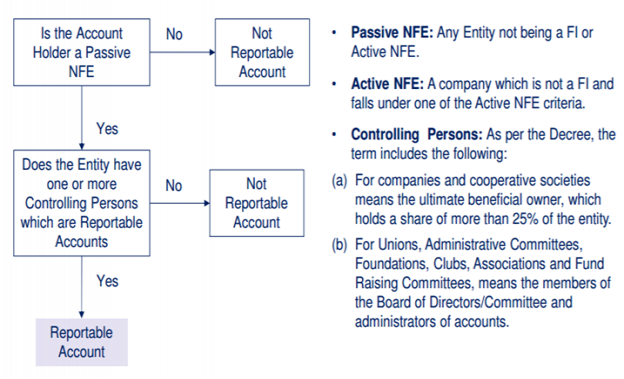

ENTITY TAX RESIDENCY SELF-CERTIFICATION FORM “Account Holder” The “Account Holder” is the person listed or identified as

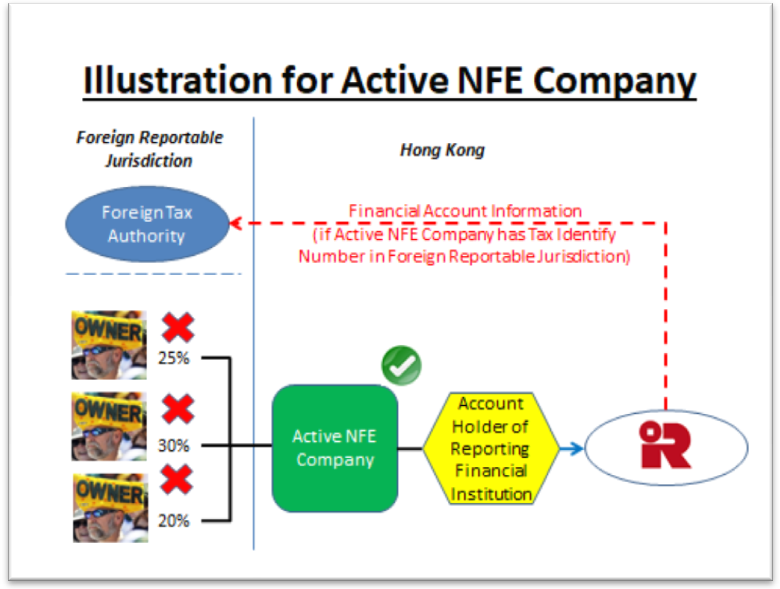

Monzo Business: Active vs Passive Non-Financial Entities (NFEs) - Business Banking - Monzo Community

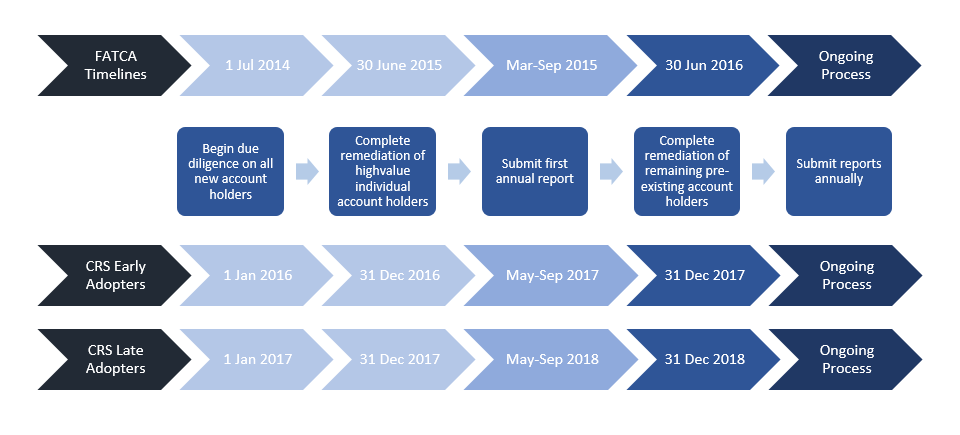

Trusts Under the Common Reporting Standard - CRS - Cyprus Lawyers | Advocates | Legal | Pelecanos Law

![Common Reporting Standard [CRS] Common Reporting Standard [CRS]](https://media.licdn.com/dms/image/C4E12AQGAmWCQDv1hAg/article-cover_image-shrink_600_2000/0/1649828227664?e=2147483647&v=beta&t=sr38hSrxPPBAKeSHz-GvaHV1nsUScMLcFILfHwjDvoA)