Dissecting Section 1202's "Active Business" and "Qualified Trade or Business" Qualification Requirements - Frost Brown Todd | Full-Service Law Firm

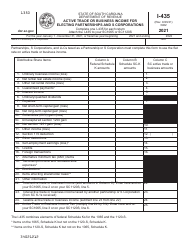

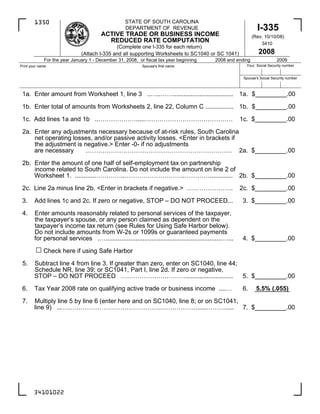

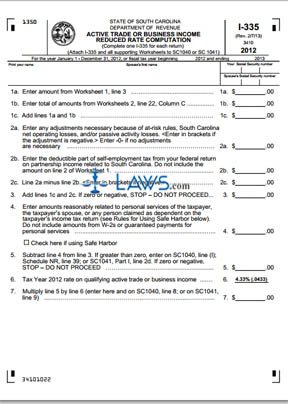

FREE Form I-335 Active Trade or Business Income Reduced Rate Computation - FREE Legal Forms - LAWS.com

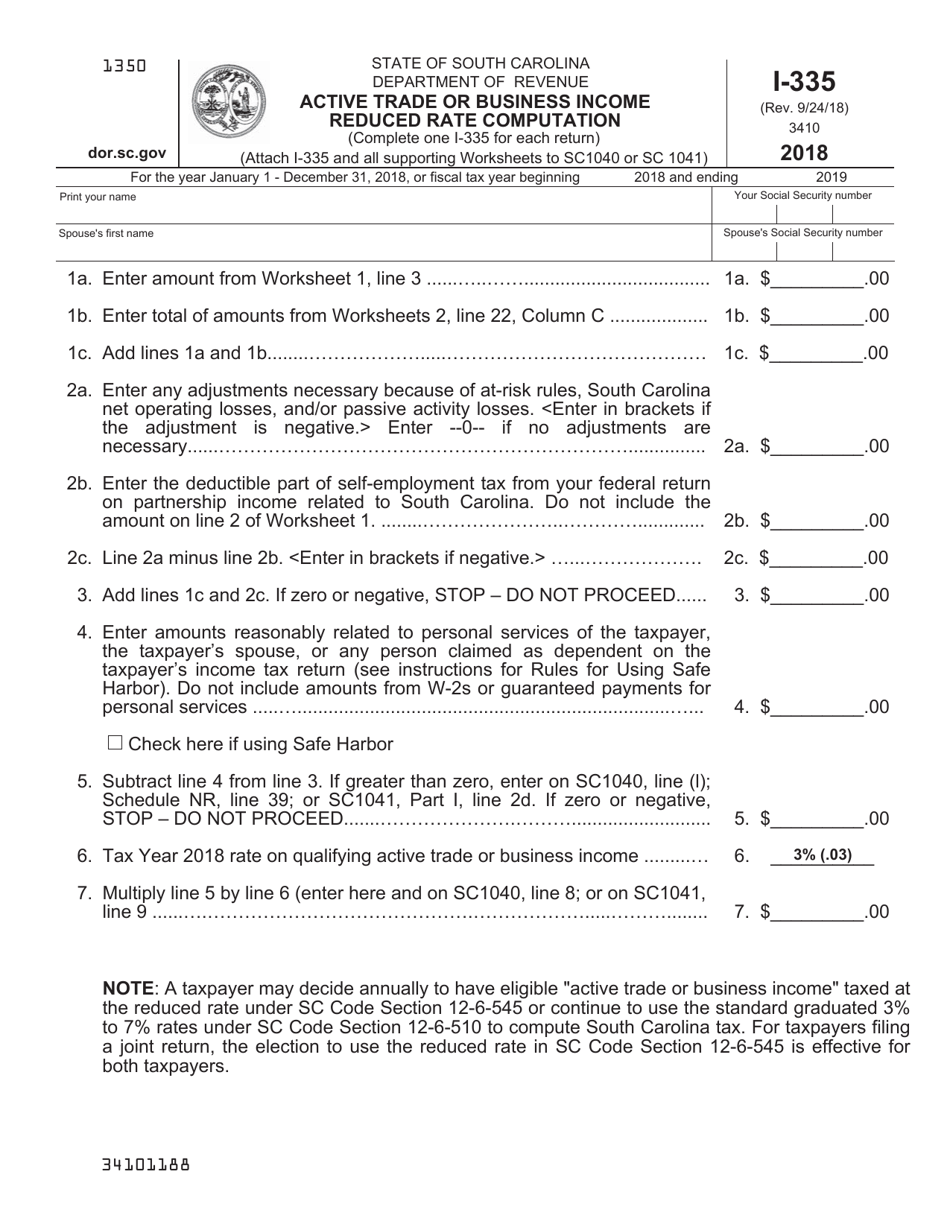

Form I335 - 2018 - Fill Out, Sign Online and Download Printable PDF, South Carolina | Templateroller

Page:United States Statutes at Large Volume 98 Part 3.djvu/814 - Wikisource, the free online library

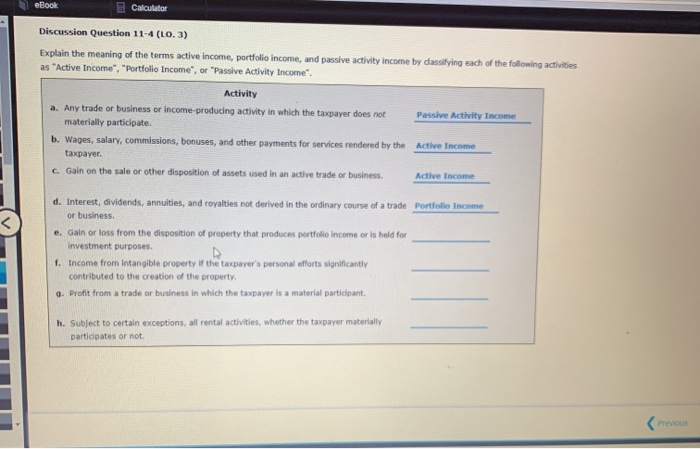

Pre-revenue companies pursuing R&D may meet active trade or business requirement - KDP Certified Public Accountants, LLP

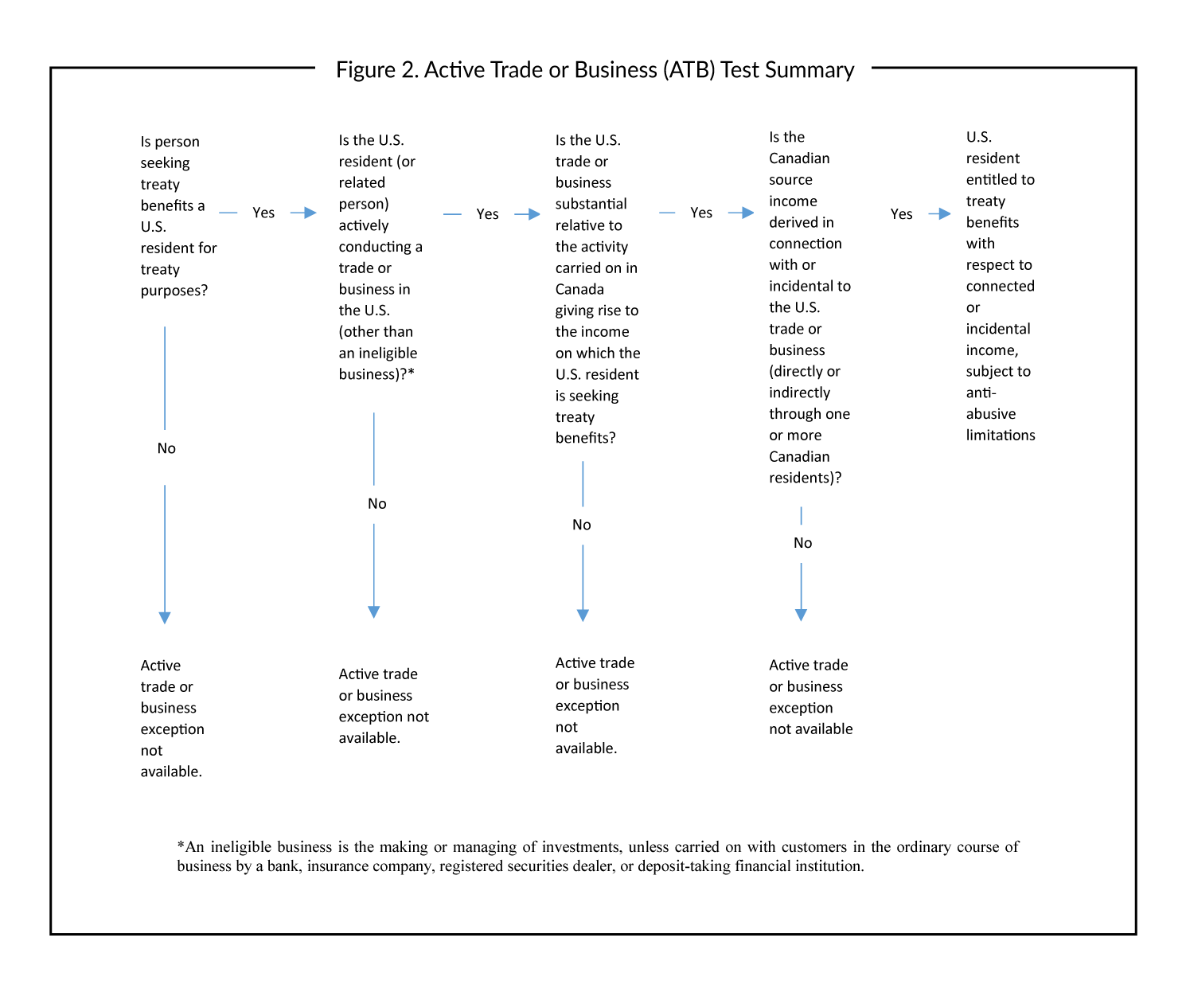

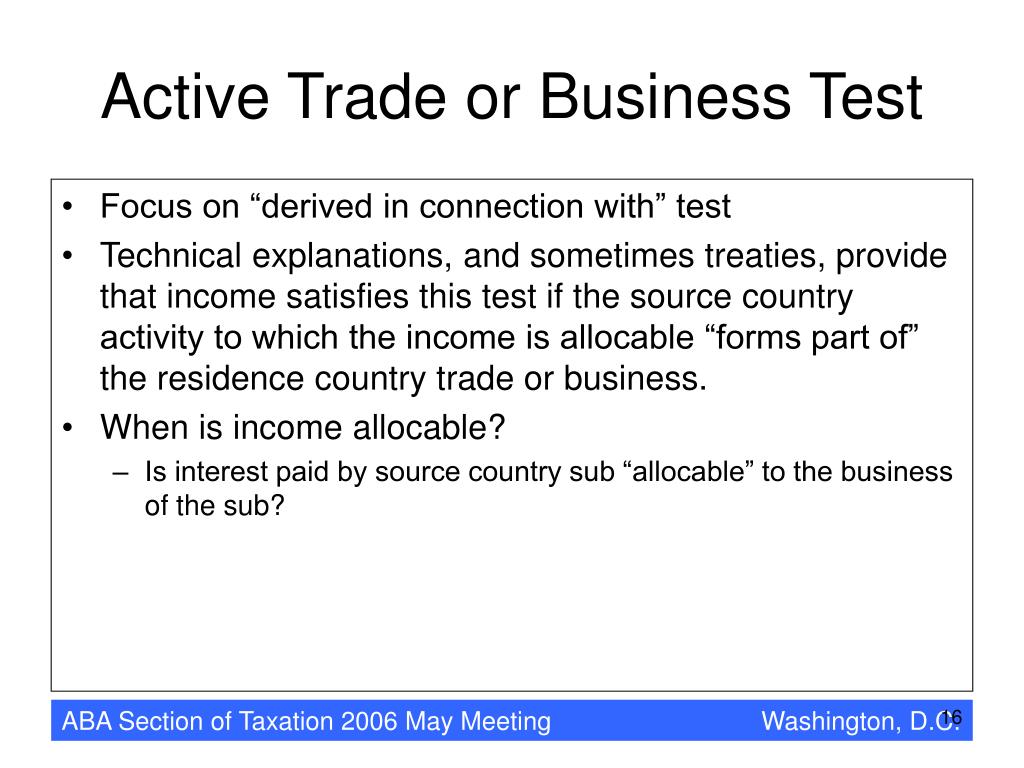

PPT - Accessing Income Tax Treaties Through Competent Authority – A Ray of Hope When All Else Fails PowerPoint Presentation - ID:143702

Dateline—U.S. New Sections 367 and 482 Regs.—Foreign Goodwill, Active Trade or Business Exception, Aggregate Transactions